10 Best CRM for Financial Advisors in 2023

Cecily Giancaterino

Cecily Giancaterino

Jul 24, 2023

∙

13 min read

CRM

As a financial advisor, two tasks can make or break your business: finding new clients and building long-term relationships. Luckily, a customer relationship management (CRM) platform can simplify those tasks, helping you achieve advisory business growth.

In this guide, we dive into the basics of CRM software for financial advisors and share our top 10 platforms. Plus, we share the features and benefits of each, so you can choose the right CRM for you.

But first, here are the key things to know about CRM software for financial advisors:

- CRM software can help you organize and manage your clients' information in one centralized location.

- CRM software informs decision-making and helps financial advisors provide relevant advice for client investments.

- A CRM platform can handle tedious and recurring tasks through automation, reporting, and powered analytics. This is a massive help for financial advisors, so they can focus more on building client relationships.

- When selecting a CRM, there are several things to consider, including features, integration capabilities, pricing, and customer support.

- Some of the top CRM options for financial advisors are FiveCRM, Wealthbox CRM, AdvisorEngine, Zoho CRM, Salesforce, Redtail, DebtPayPro, Ugru CRM, NexJ Systems, and Creatio.

Table of Contents:

What Is CRM Software for Financial Advisors?

CRM software helps financial advisors organize and manage client information in one central location. It provides tools and resources for scheduling appointments, maintaining a client contact list, tracking communications, creating reports, and analyzing client data.

Plus, CRM platforms empower financial advisors to analyze and interpret client data, providing insights to help them make better decisions about client investments.

CRM software for financial advisors helps you streamline your workflow and more effectively manage your time. This allows you to devote more time to developing client relationships and providing trusted financial advice.

How to Evaluate CRM Software for Financial Advisors

Each CRM software comes with its own pros and cons. To choose the right one for you, there are a few key considerations to make.

Features and Integrations

Aside from a clean interface and user-friendly dashboard, consider the software's automation, customization, and integration capabilities. Here are some key questions to ask:

- Does the CRM automate tasks such as lead management, policy handling, and claims processing?

- Does it allow customization, and can you tailor the software to fit your workflow?

- Does it integrate with your other software applications, such as accounting or marketing automation tools?

Customer Support

Assess the quality of support the vendor provides. You'll want to ensure the vendor offers a range of training materials to make onboarding and team training simple. These materials may include everything from video tutorials to webinars.

Next, evaluate the quality and responsiveness of the software’s support team. You can do this by reading reviews and taking a test drive of the CRM software.

Pricing

The cost of CRM software can vary significantly, and many factors influence it. For instance, the number of users accessing the software, storage requirements, and the range of features the CRM offers all impact the total cost.

Some vendors offer subscription-based pricing, others offer a one-time purchase, and some CRM software providers offer various pricing tiers. Consider your budget as well as other costs such as training and customer support fees.

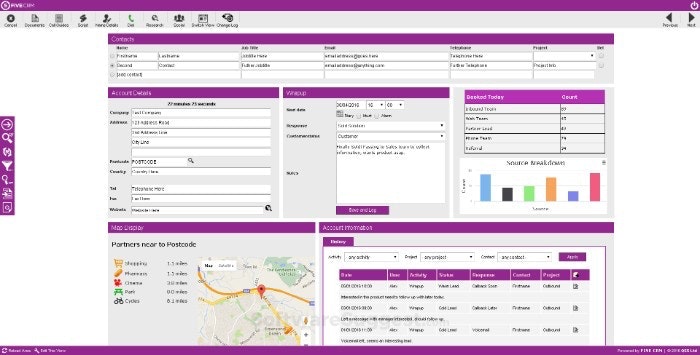

1. FiveCRM

Rating: 4.4/5.0 (G2)

Key Features:

- Complete customization: You can customize FiveCRM's interface and functions to match your unique workflows.

- Sales pipeline management: Visualize and manage the entire sales process, from inquiries to client relationship management.

- Real-time reporting: Understand which touchpoints drive the highest customer engagement so you'll know how to increase client retention and offer personalized financial advice.

- Powerful automation tools: Automate repetitive and mundane tasks so you can focus on building relationships with clients.

- In-built security: FiveCRM offers built-in security and privacy measures so you can protect your clients' critical financial information.

FiveCRM is a highly customizable CRM platform that can be custom-tailored to fit the way you work. You can customize everything from workflows to dashboards to reports.

FiveCRM's automation capabilities enable you to automate those tedious tasks, such as call-backs, so you can focus on building relationships. Plus, real-time data provides actionable insights you can use to provide better services to your clients and make smarter business decisions.

Other features, such as built-in telemarketing and email marketing, help financial advisors simplify client communication and engagement. All of these capabilities and features make FiveCRM the complete CRM solution for financial advisors.

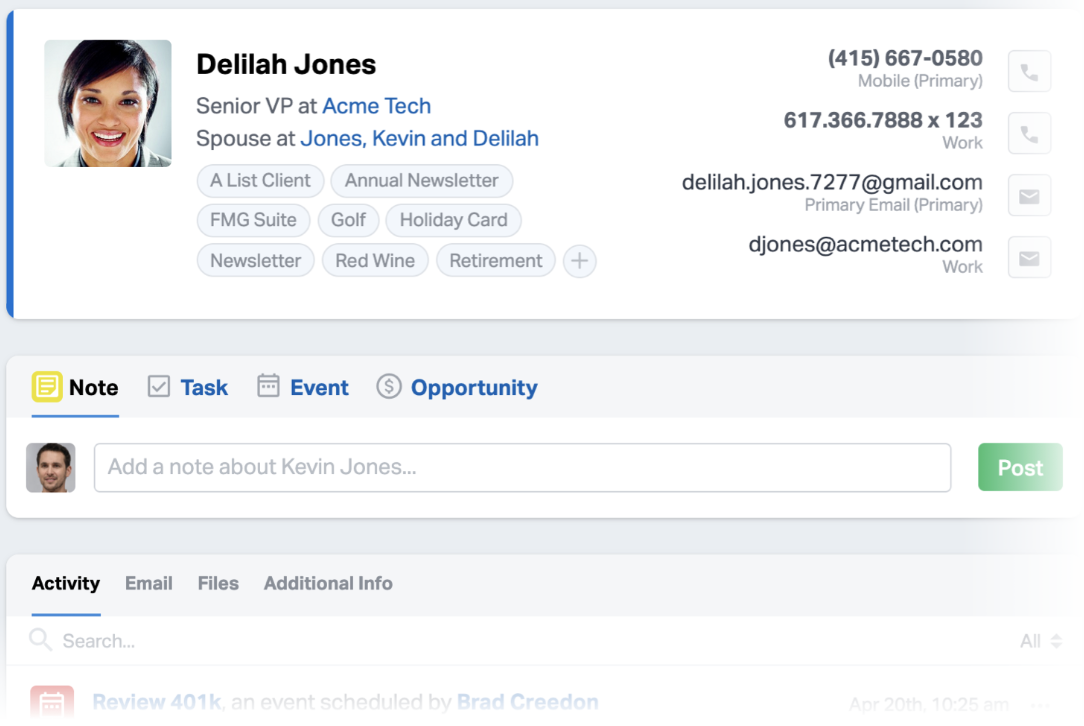

2. Wealthbox CRM

Rating: 4.6/5.0 (G2)

Key Features:

- Contact record page: Get a comprehensive view of your clients with a user-friendly layout and efficient note-taking interface. Easily manage phone calls, emails, files, and financial information in one place.

- Social profiles: Stay current by viewing your contacts' social networking activity on a single platform. Stay updated and engage with your prospects and clients on networks like Twitter.

- Click-to-call: Save time and boost productivity with one-click phone calls. Wealthbox's seamless system allows you to connect with clients instantly. When you click on their number, the system will initiate a call between you and your contact.

Wealthbox is a top-rated CRM tool for small firms and independent financial advisors. Users enjoy a short learning curve because of an interface that's intuitive and easy to navigate.

Wealthbox's collaborative management feature enables team members to log in, view, and collaborate on a shared activity stream. Other features, such as task management tools and automated workflows, help you stay organized and ensure you never miss a client follow-up.

3. AdvisorEngine

Rating: 3.9/5.0 (G2)

Key Features:

- Growth tools: AdvisorEngine offers tools for capturing and connecting with prospects, including simple web forms, connected calendars, and marketing integrations. Using these tools, you can grow relationships by staying connected with your clients throughout the life of your relationship.

- Contact management: Use tools such as client dashboards to manage contacts and quickly surface critical client details.

- Practice management: Manage your practice with ease by building custom workflows, automating tasks, using business intelligence dashboards to visualize data, and more.

AdvisorEngine is an industry-leading CRM software solution built for wealth management professionals. Its key features include financial data capture, real-time activity tracking, task management, contact management, and more.

AdvisorEngine provides reminders and task management options so advisors never have to miss a deadline. Customization options are also available, such as templates for email marketing and social media posts, allowing for targeted outreach to increase client acquisition.

4. Zoho CRM

Rating: 4.0/5.0 (G2)

Key Features:

- Lead management: Effortlessly capture leads, streamline lead scoring, identify high-converting leads, and seamlessly follow up with comprehensive contact details.

- Contact management: Gain valuable, real-time insights into your customers, effortlessly connect with them through various channels, and build enduring relationships.

- Workflow automation: Save time and effort by automating each step in your workflow, including lead follow-ups and field updates.

Zoho CRM features tools to manage client interactions, automate repetitive tasks, and analyze sales data. Zoho CRM's key features include lead and contact management, sales forecasting, workflow automation, collaboration tools, and mobile access. The platform is best known for its flexibility, allowing financial advisors to customize the software to suit their unique workflows.

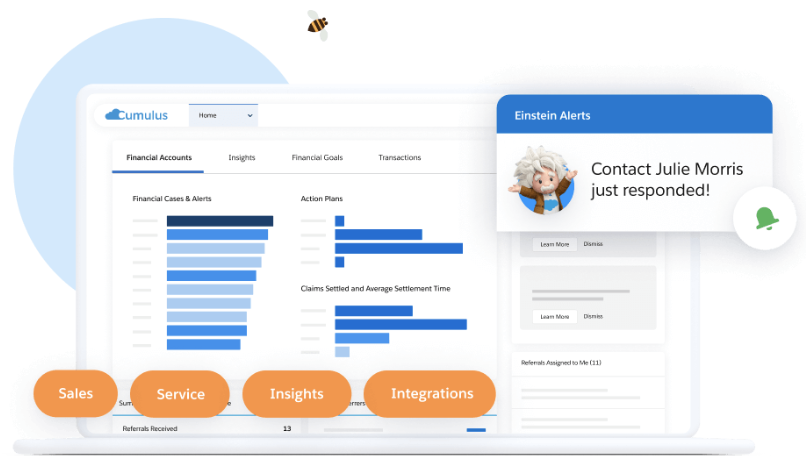

5. Salesforce Financial Services Cloud

Rating: 4.2/5.0 (G2)

Key Features:

- AI tools: Built on Salesforce, this platform offers a wide range of AI-driven CRM tools for sales engagement and enablement. You can automate your sales process, automatically generate customer insights, and so much more.

- Real-time data insights: The platform includes robust data analytics you can use to glean real-time insights about your business and clients. As a result, you can provide personalized experiences to your clients and make educated business decisions.

- Client onboarding support: Salesforce provides built-in tools for streamlining client onboarding, helping you deliver an excellent client experience.

Salesforce Financial Services Cloud is a comprehensive solution for banking, insurance, and wealth management organizations. It's built on Salesforce, one of the top CRM platforms on the market.

While it features hundreds of useful features, Salesforce's key differentiator is its scalability. It allows advisory businesses of all sizes to adapt and grow with the platform. The solution offers many native enhancements to simplify complex financial processes and ensure optimal workflow.

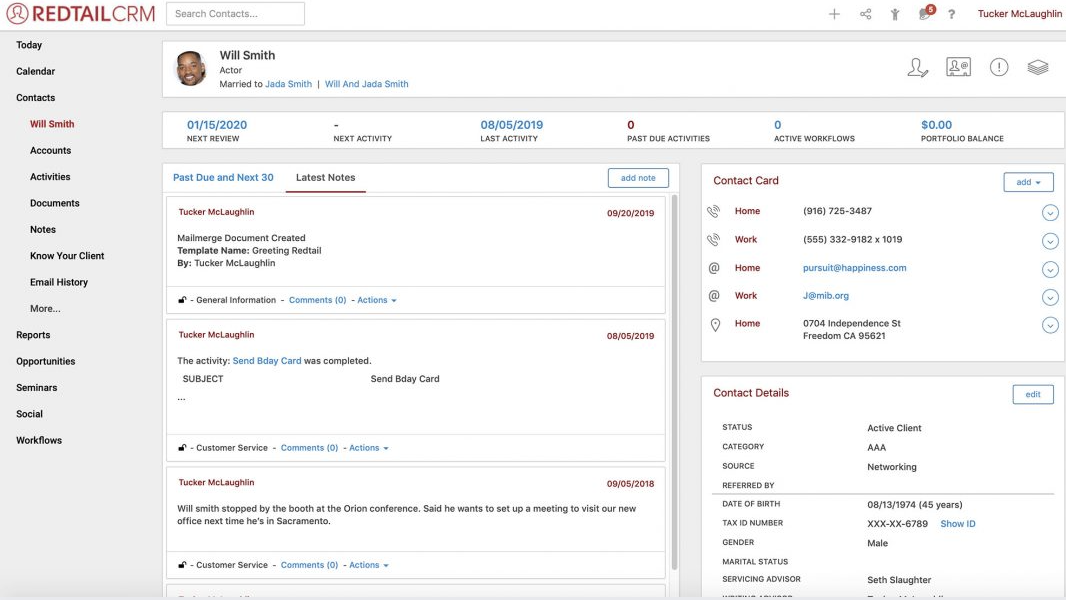

6. Redtail

Rating: 4.3/5.0 (G2)

Key Features:

- Workflows: Design and implement customized workflows that match your existing processes.

- Notes: Capture and track your client history. Notes are integral to documenting who you spoke with, the reason for the conversation, and when it occurred.

- Seminars: The seminar tool is a valuable tracking tool for call campaigns and email campaigns, helping you streamline and standardize your contact processes.

Redtail offers low-cost solutions and a user-friendly platform that integrates with several applications in the financial industry. It's a flexible and convenient tool for advisors at any experience level. Redtail also allows advisors to track exactly what has been done with each client, enabling easy information sharing throughout your firm.

7. DebtPayPro

Rating: 4.4/5.0 (G2)

Key Features:

- Task automation: Simplify your tasks by automating them based on milestones and rules. Delegate responsibilities to users, teams, and clients effortlessly.

- Built-in payment tools: Collect, split, and distribute client payments, and access useful tools such as fee calculators.

- Document creation tools: Financial advisors can effortlessly create and customize various documents, including letters, forms, contracts, and more.

DebtPayPro was founded in 2009 and was originally designed as a debt settlement tool. It has since evolved into a platform that touches on every aspect of financial management. It boasts various features like contact tools, document management tools, payment processing, and analytics.

DebtPayPro also provides advisors and small firms with specialized services like student loan consolidation and credit repair tools. This is a key differentiator between DebtPayPro and the other platforms in this list.

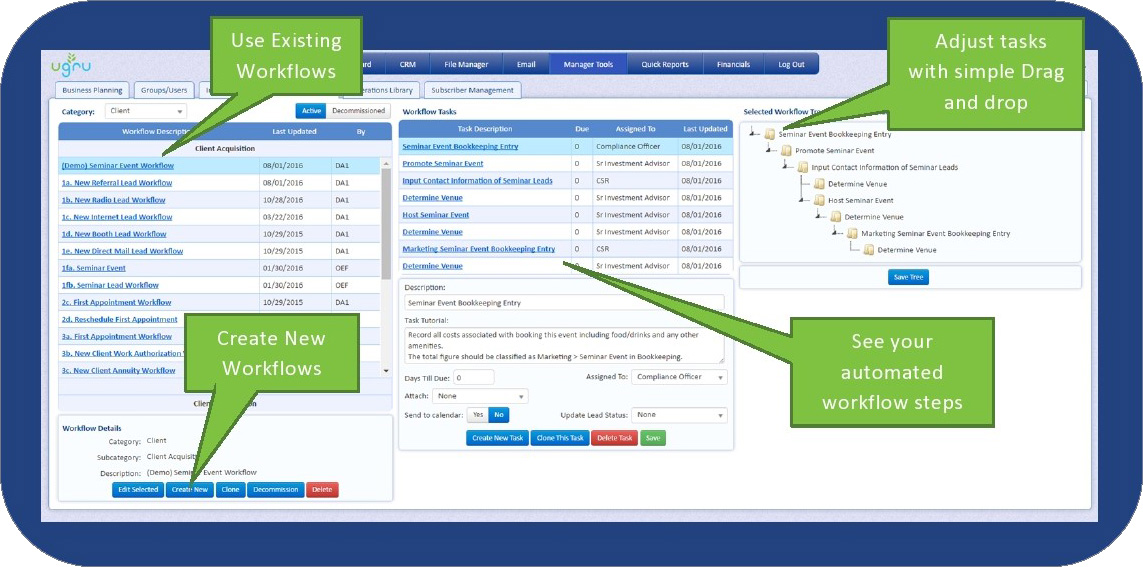

8. Ugru CRM

Rating: 5.0/5.0 (G2)

Key Features:

- Marketing automation: Using Ugru CRM, you can build marketing tools such as drip campaigns automatically. Other features include campaign analytics and workflow automation.

- Data management: Easily manage data such as contact records and client notes in one, centralized location.

- Task management: Visualize client service tasks such as client follow-ups across workflows.

Ugru is a CRM solution for small and growing advisory firms. Ugru's key features include marketing automation, workflow automation, and customization options, so you can tailor the software to fit your processes.

Ugru's reporting tools provide valuable insights into pipeline activity and campaign performance, allowing businesses to make informed decisions and further optimize their sales and marketing efforts.

9. NexJ Systems

Rating: 4.5/5.0 (G2)

Key Features:

- Lead management: NexJ Systems offers tools for capturing, scoring, and nurturing leads. Capabilities include interactive dashboards and advanced filtering options.

- Intelligent recommendations: Get intelligent investment recommendations via NexJ's built-in AI tools.

- Automated onboarding: NexJ Systems allows you to easily onboard new clients by automatically launching the necessary workflow tasks.

NexJ is an all-in-one CRM designed for those in the financial industry. The platform uses artificial intelligence, machine learning, and analytics to help advisors streamline their workflows, provide timely financial recommendations, and more.

NexJ's Comprehensive Customer View provides immediate, real-time data about your clients and their accounts. And its Digital Assistants, available through NexJ Nudge, help you identify cross-selling opportunities and deliver timely and supportive financial content to your clients.

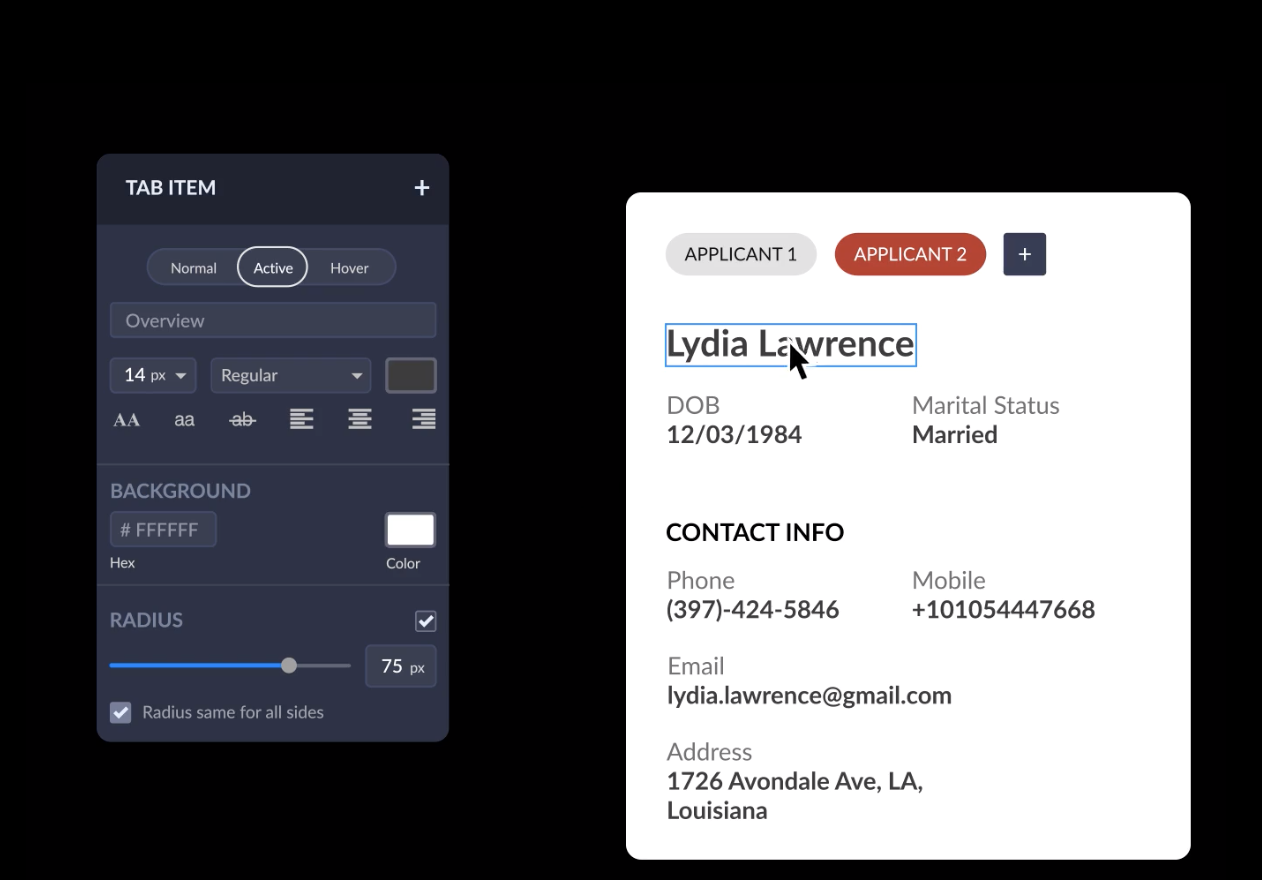

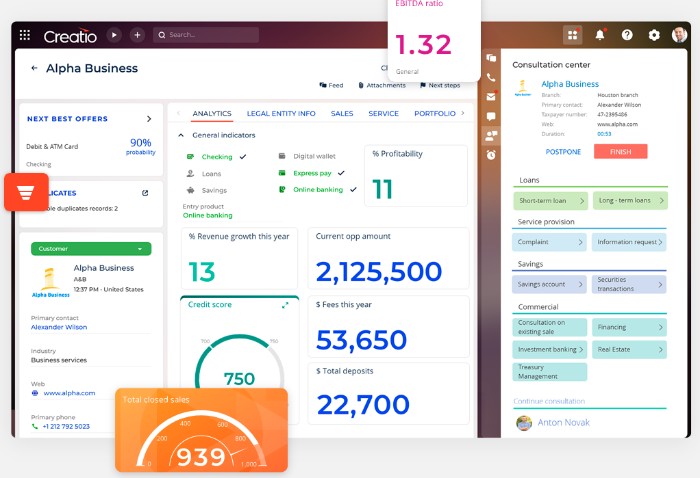

10. Creatio

Rating: 4.6/5.0 (G2)

Key Features:

- No-code UI builder and drag-and-drop visual design tools: Easily build and customize data and outreach campaigns without coding.

- Lead management: Simplify your lead management with Creatio's unified database. Track and capture leads from various sources while ensuring automated data verification.

- Agent management: Run a firm of financial advisors? With Creatio, you can use the built-in agent management tools to support your advisors in streamlining their daily tasks, managing customer requests, and organizing communications.

Creatio's innovative CRM platform offers powerful no-code tools and out-of-the-box capabilities. It enables advisors and firms to gather extensive customer data and create multichannel marketing campaigns in just a few clicks.

One of the key features of Creatio is its customizable client segmentation capabilities. This allows you to personalize your marketing and sales strategies based on certain criteria, leading to better client engagement and conversion rates.

Strengthen Client Relationships With FiveCRM

Financial advisors must have the necessary tools to manage their workflows and provide high-quality service to their clients. FiveCRM enables you to do just that through customizable workspaces, real-time data analytics, and powerful automation.

Investing in a reliable CRM like FiveCRM can help improve your firm's processes and increase productivity levels, leading to higher sales conversions and better client relationships. To see how FiveCRM can transform your financial advisory firm, request a demo today!

FAQs: CRM For Financial Advisors

Q: What is the purpose of CRM software for financial advisors?

A: CRM software organizes client information, schedules appointments, tracks communications, creates reports, and analyzes data. This helps financial advisors streamline workflows, save time, and focus more on building client relationships and offering trusted advice.

Q: What factors should I consider when choosing a CRM for my financial advisory firm?

A: When choosing a CRM, consider its features, integration capabilities, pricing, and customer support. Check if it automates tasks, can be customized to fit your workflow, and integrates with your other software. Also, consider customer support quality and total cost, including training and support fees.

Q: What are the benefits of using FiveCRM as a CRM for my financial advisory firm?

A: FiveCRM offers customization, sales pipeline management, real-time reporting, automation tools, and in-built security. It's customizable to fit unique workflows and automation frees advisors from tedious tasks, allowing a focus on building relationships.

Q: How does CRM software support decision-making for financial advisors?

A: CRM software provides tools to analyze and interpret client data, aiding in investment decisions, delivering personalized advice, streamlining workflows and effective time management, allowing advisors to devote more time to client relationships.

Michael King says...

"I can’t think of a time where a client has requested something that we weren’t able to do with FiveCRM. Unlike most systems, it has a lot of flexibility."

Managing Director, Senior Response

JAINE HUSBANDS SAYS...

“Each client, and each of their campaigns, has its own unique specifications. We essentially needed to set up mini CRMs on one platform to meet those requirements.”

Operations Director, Team Marketing

Why wait?

Start improving your outbound efficiency now, with the most customizable Sales solution on the market.